With 5G rolling out across the globe, there’s been substantial attention showered on edge computing as a crucial enabler for specific capabilities such as ultra-reliable low-latency communication (URLLC) support. Edge and 5G have become synonymous even though carrier networks had already employed edge computing before 5G rollouts. Under 5G, though, the edge, or “multi-access edge computing” (MEC), is much more expansive and will become a critical capability for both fixed and mobile carriers.

There is a continuum for the edge, from public cloud edges provided by hyperscale cloud providers, including Amazon, Microsoft, Google, Baidu, Alibaba, and Tencent, to on-premises edge stacks at enterprises (or even in consumer homes). Analyst estimates of how much compute will be performed at the edge in the next 5 years varies widely, from 50% to 75%. Regardless, carriers need to develop their MEC strategies to service the upcoming edge computing market.

This feature explores why such a platform is needed and what components are needed for this platform.

The ubiquitous MEC platform

Regardless of whether carriers choose to pursue their MEC strategy on their own or involve partners, most carrier MEC platforms will include a hardware component, a software infrastructure component, and a management and orchestration solution. Carriers may pick their partners from a rich edge ecosystem: virtualization and container platform providers, network equipment providers, system integrators or hyper-scale cloud providers.

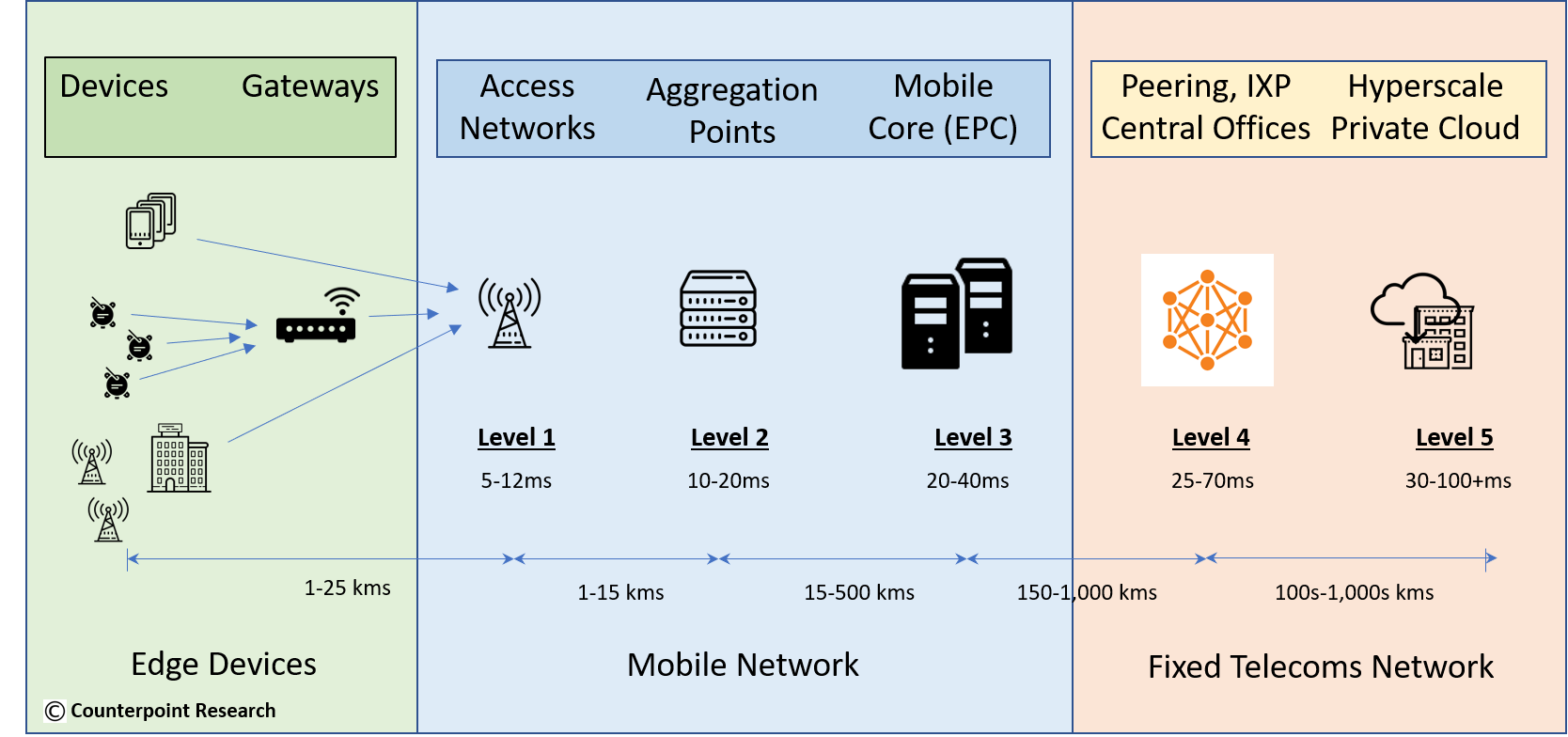

Further, different use cases will demand that MEC capabilities be present at different locations, providing different latency options and facing different physical and environmental challenges. Just as the edge is a continuum from on-premises to the regional data centers, the carrier MEC platform should also span the spectrum and be equally comprehensive.

In mobile networks, MEC platforms will show up first at aggregation points like mobile switching centers (MSCs). Subsequently, MEC options may include cell-site towers and street-level cabinets aggregating mmWave small cells. Especially as virtualized RAN gains momentum, MEC platforms that can run the disaggregated RU (RAN unit), DU (distributed unit), and CU (centralized unit) will spread towards the radio edge.

For wireline networks, MEC platforms are showing up in next-generation central offices (COs) or at cable headends at multi-service operators (MSOs). These locations provide an opportunity for carriers to run edge workloads with proximity to both enterprise and consumer customers.

In addition to carrier-managed premises, enterprises may seek edge solutions from their service providers as well. In these situations, enterprises will demand an option for an on-premises edge. This edge will take the form of either MEC capabilities on CPE (or uCPE) or additional MEC servers installed at customer premises.

The role of network equipment providers (NEPs) in enabling ubiquitous MEC

Given the requirement for a pervasive MEC environment across multiple locations, there is an opportunity for NEPs who have a rich portfolio of solutions to step up and offer a ubiquitous embedded platform across their range of offerings. Platforms can range from wireline systems like BBU or BRAS (or even the OLTs) and end-customer platforms like uCPEs. For wireless deployments, telcos will want MEC offerings that they can use in MSCs, as well as hardened systems deployable at cell sites and in street-level cabinets. To be comprehensive, such a system would also need to support white-box servers that telcos can deploy in any data center or mini data center location, including at customer premises.

Compared to a piecemeal MEC approach that carriers are trying to put together today, ranging from partnering with SIs to picking a subset of solutions from NEPs to working with hyperscalers in select locations, a more uniform, consistent platform approach might be an appealing alternative.

For a NEP to execute this strategy, a uniform infrastructure layer (historically labeled the NFVI and VIM under ETSI NFV) would need to be provided across all these instantiations and include orchestration and management to provision, deploy and manage the lifecycle of applications across multiple locations. Since edge workloads are likely to be varied, the platform will need to support NFV-style VNFs to more modern CNFs. This means there will be support for bare metal platforms to VMs to containers and potentially serverless in the future.

Importance of a software-centric cloud-like approach

The other challenge for NEPs looking to build such a unified platform is ensuring strong software and integration capabilities. Hyperscale cloud providers have built developer-friendly ecosystems, and software stacks focused on self-service. Hyperscalers empower the end-user to build, automate, and scale application deployment, often through integration with platform APIs. Carriers that want to compete or even partner with hyperscalers will need platforms that provide similar API-centricity and self-service capabilities.

Beyond APIs and self-service edge platform functionality, another key element to success is a cloud-based management platform, complete with cross-domain orchestration and built-in monitoring and telemetry features.

For some NEPs this will be a new challenge, given that they’ve historically focused on developing appliance-based solutions in siloed divisions: access routing versus transport solutions BUs, mobile division versus optical division versus wireline division. However, a NEP that can envision, design and develop a uniform platform approach for MEC workloads can meet today’s pressing carrier needs. Ultimately, this platform can fulfill end-user applications requirements by providing MEC across multiple locations to execute different workloads with different latency needs.