These are the technologies and issues that will matter to you in 2023.

As the turn of the year approaches, the annual ritual of identifying tech trends and making predictions for the next solar orbit swings into action. Such exercises are always interesting but also inherently risky – particularly in uncertain times such as those we have recently experienced and continue to live through.

Then, just as economies were adjusting to and recovering from the pandemic, Russia’s invasion of Ukraine in February 2022 caused a sharp rise in energy prices, increased inflation, supply chain issues and fears of widespread recession. This series of shocks has profound implications for the IT industry that look set to continue through 2023 and beyond.

So perhaps the biggest benefit of the annual round of tech soothsaying is not so much the fine-grained detail – which is often derailed by contact with unexpected events – as the chance to take stock of the general direction of travel.

Let’s look at the latest crop of trends and predictions.

What the analysts say

Gartner

Gartner’s top 10 strategic technology trends for 2023 are grouped under three themes:

- Optimizing IT systems for greater reliability, improving data-driven decision making and maintaining the value integrity of production AI systems.

- Scaling vertical offerings, increasing the pace of product delivery and enabling connectivity everywhere.

- Pioneering business model change, reinventing engagement with employees and customers, and accelerating strategies to tap new virtual markets.

Overarching all these trends is sustainability: “Every technology investment will need to be set off against its impact on the environment, keeping future generations in mind. ‘Sustainable by default’ as an objective requires sustainable technology,” says Gartner’s David Groombridge. Support for this view comes from Gartner’s 2022 CEO and Senior Business Executive Survey, which found that environmental sustainability was the third largest driver, behind performance and quality, among the 80% of CEOs planning to invest in new products in 2022/23.

Image: Gartner

A digital immune system (DIS) uses a variety of techniques – including AI-augmented testing and software supply chain security – to improve the quality and resilience of business-critical systems. Applied observability takes raw data, adds context and analytics, and generates data-driven business and IT decisions. AI trust, risk and security management (AI TRiSM) covers AI model governance, trustworthiness, fairness, reliability, robustness, efficacy and privacy.

Industry cloud platforms combine software, platform and infrastructure as a service with tailored, industry-specific functionality. Platform engineering provides the tooling, capabilities and processes required to optimise developer experience and accelerate digital delivery. Wireless-value realization covers the delivery of business value via end-user computing, edge devices and digital tagging (RFID).

Superapps are an amalgam of an app, a platform and an ecosystem, where third parties can develop and publish their own mini-apps. Adaptive AI systems use real-time feedback to adjust their learning and adapt to changing circumstances in the real world. Metaverse is a ‘collective virtual 3D shared space’ with an economy based on cryptocurrencies and NFTs.

IDC

IDC’s worldwide IT industry predictions for 2023 cover the key drivers for the next five years – which, as we have outlined above, are likely to see significant economic turmoil. Or, as analyst Rick Villars puts it: “For the next several years, leading technology providers must play a leading role in helping enterprises use innovative technologies to slide through the current storms of disruption.”

However, the wider message is more optimistic: “Technology and IT is not about where we cut – technology is where we invest to help the rest of the business navigate the recession,” says Villars. “This is the continued transition, which we started to see two years ago, towards digital business.”

For IDC, ‘digital business’ covers everything from processes, through products and services, to experiences, and will be delivered by a ‘dream team’ combination of IT and business units.

Here are some of IDC’s key predictions:

- In 2025, 60% of infrastructure, security, data, and network offerings will require cloud-based control platforms that enable extensive automation and promise major reductions in ongoing operating costs.

- Through 2024, shortcomings in critical skills creation and training efforts by IT industry leaders will prevent 65% of businesses from achieving full value from cloud, data, and automation investments.

- Sovereign assertions in sustainability, resiliency, and asset residency through 2025 will force CIOs to shift staff, budgets, and operating processes for more than 35% of IT and data assets.

- In 2023, 70% of enterprises’ adoption of as-a-service infrastructure/software will be curbed more by an inability to assess promises of faster innovation and operational gains than by cost concerns.

- By the end of 2024, 60% of platinum-Level aaS offerings in security, business operations, and DaaS will include bundled access to specialized SME teams to help reduce impact of skills shortages.

- In 2026, 45% of G2000 enterprises will continue to face material risks due to frontline workers’ and business leaders’ unwillingness to trust actions initiated by vetted autonomous tech systems.

For the remainder, see here.

Image: IDC

IDC’s final thought for 2024 and beyond is that automation – of IT operations, business processes and application development – will be critical for scaling digital business.

Forrester

Organisations need to concentrate on their core missions and strengths in difficult times, according to Forrester: “In 2023, smart business leaders will get focused – pruning efforts that aren’t bearing fruit and prioritizing long-term growth. Economic and geopolitical turmoil will sow fear and disruption, yet panic, short-sighted revenue grabs, and poorly planned returns to the office will only make things worse.”

Here are some of Forrester’s key predictions:

- Consumers are cautious but don’t pull back on spending.

- A skills shortage challenges CX teams’ ability to thrive.

- Monitoring technology riles employees.

- Greenwashing becomes a serious business risk.

- Leaders try to force employees back into the office, with disastrous results.

- Metaverse experiments fall short of capturing the public’s imagination.

- The talent crunch pushes tech executives to seek new sources of candidates.

- Scandals at tech companies burn through consumer trust.

A key business/tech priority for 2023, Forrester says, is trust – in various guises. “Customers are increasingly weary of organizations playing fast and loose with their personal data, and regulators aren’t far behind. And it won’t stop there – fueled by the ire of fed-up customers and employees, regulators will scrutinize greenwashing, misinformation, and employee surveillance.”

CCS Insight

One research firm that is very much in the business of fine-grained prognostication is CCS Insight, which recently held a three-day online event featuring analyst presentations, interviews with executives from Samsung, EE and Qualcomm, and no fewer than 100 predictions.

Rather than list all 100 predictions (you can find them here), I’ve selected a couple from each category that caught my eye:

| Category | Prediction |

| Silicon Foundations | Attempts to rebalance the geographic diversity of semiconductor manufacturing fail, and Taiwan maintains its lead |

| Quantum computers achieve 60-second coherence time by 2025 | |

| Sustainability | By 2027, mobile apps enable users to track their carbon footprint in real time |

| By 2024, an international standard develops for calculating the carbon emissions of cloud services | |

| Infrastructure Advances | China’s early development of 6G results in at least two competing standards in the East and West |

| By 2024 a major mobile network suffers an outage as multiple DNS gateways fail simultaneously | |

| Connectivity Providers | By 2025 satellite broadband provider Starlink is spun off from SpaceX as a publicly listed company |

| By 2025, at least 25 telecom operators offer connected car services as an add-on to consumer 5G plans | |

| Regulation | The EU’s Digital Markets Act ends preferred product placement in search results by 2024 |

| Clear signs of a Russian–Chinese “splinternet” emerge by 2023 | |

| New Opportunities | Apple enters the US health insurance business in 2024 |

| By 2026, more companies follow Tesla in investing in mineral supply chains | |

| Personal Futures | By 2028, a “blockchain of you” lets developers build viable digital twins of people to support personalized services |

| By 2030, intelligent wireless body monitoring leads to pervasive and personalized healthcare | |

| Changing Workplace | By 2024, enterprise collaboration tools add immersive spaces to help replicate the in-office experience |

| Demand for software that measures and tracks the link between employee experience and customer experience accelerates in 2023 | |

| Virtual Worlds | Apple’s venture into spatial computing entirely avoids using established terminology such as virtual reality, augmented reality or the metaverse |

| By 2025, Meta launches a virtual reality headset controlled by an inbuilt neural sensor | |

| Connected Devices | By the end of 2026, more than 25 million people access the Internet through a mobile phone connected directly to satellites |

| Apple launches a foldable iPad in 2024 |

In a panel discussion at the event, CCS Insight analysts discussed how satellite connectivity is likely to complement rather than usurp terrestrial fixed and mobile networks, while noting the recent flurry of satellite service announcements from smartphone manufacturers. Also covered by the panellists was the state of play in the metaverse, sustainable technology and the smart home.

A roundup of 2023 predictions

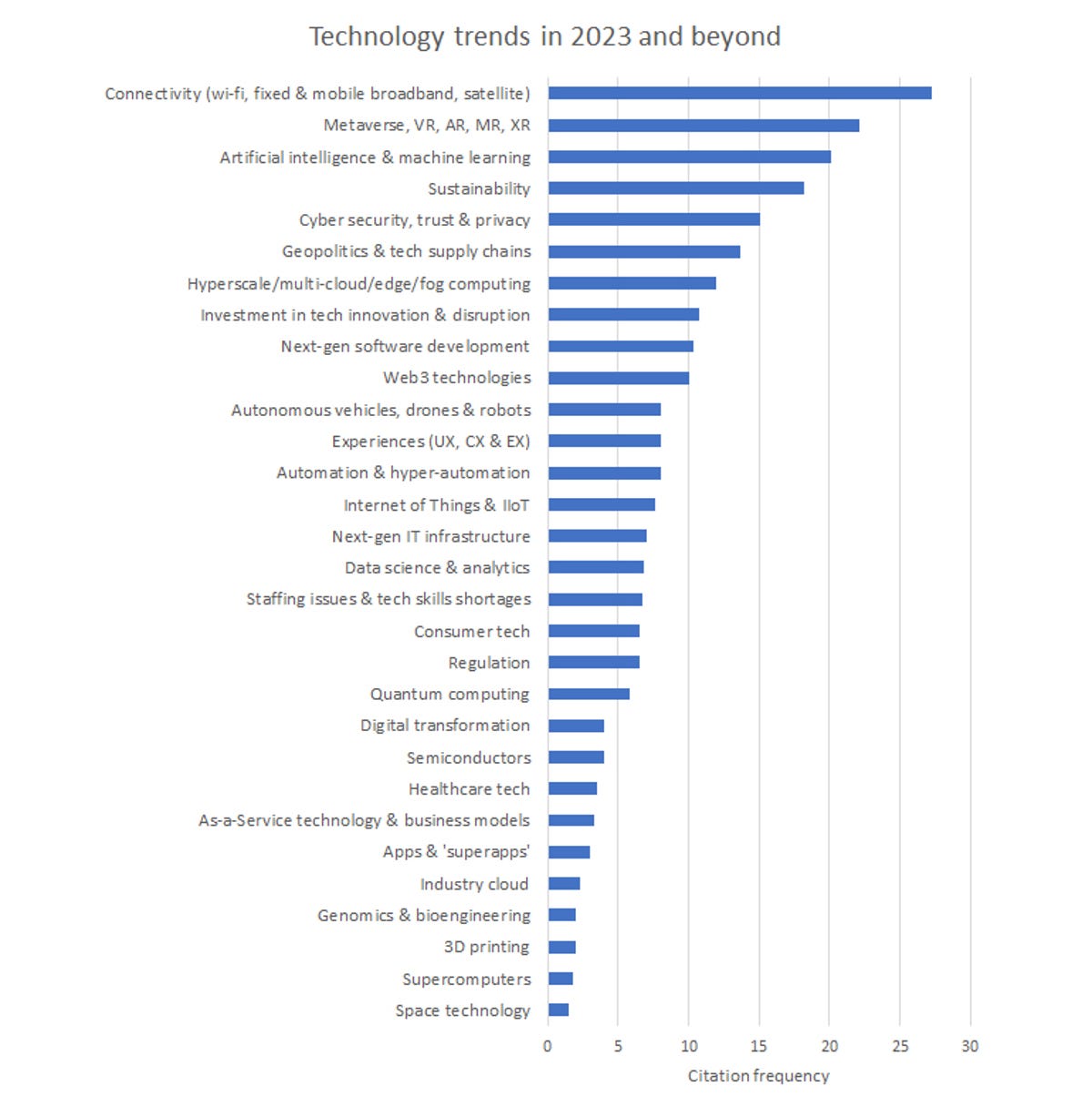

There’s clearly a lot to digest in the analyst predictions described above. To try and get an overall picture, we’ve taken these and predictions from a range of other recent forward-looking surveys and articles, and assigned them to emergent categories. Here’s what the resulting chart looks like:

Data & chart: ZDNET

It’s no surprise to find connectivity – wi-fi, fixed and mobile broadband, and satellite – heading the rankings, as this basically underpins the entire digital world. Similarly, prominent showings for artificial intelligence (AI) and machine learning (ML), cybersecurity, cloud computing and software development are not unexpected. The metaverse’s runner-up spot, along with VR/AR/MR/XR, confirms its status as the most-hyped technology of the moment, while the presence of ‘Geopolitics & tech supply chains’ in sixth place is a sign of the times.

By: Charles McLellan, Senior Editor

Source: https://www.zdnet.com/article/tech-in-2023-weve-analysed-the-data-and-heres-whats-really-going-to-matter/ 14 11 22